Three-month TONA futures

market information

Click here for Product outline.

Delayed by 10 minutes.

Three-month TONA Futures

What is TONA

Tokyo Overnight Average rate (TONA) is JPY interest rate for uncollateralized transactions settled on the same day as the trade date and maturing the following business day between financial institutions at the interbank call money market.

Listing of Three-month TONA Futures

TONA is the designated risk-free rate (RFR) administered and published by the Bank of Japan.

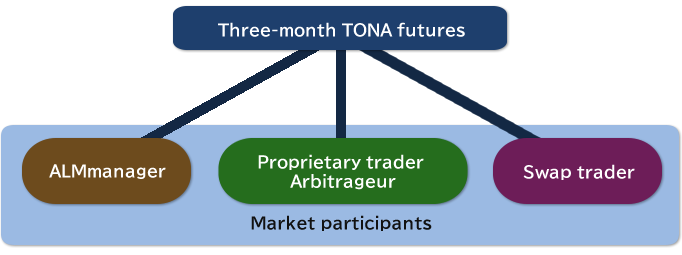

As JPY LIBOR publication was ceased at the end of December 2021, it has become essentially necessary to establish a RFR based market. TFX has listed Three-month TONA futures in order to provide market participants with price discovery, which is the basic functionality of futures, and to improve its recognition of RFR as a benchmark of JPY interest rate.

Three-month TONA futures designates, as underlying asset, an interest rate per annum that is calculated by compounding daily TONA during the Three months’ “Reference Quarter”.

Hedging tool for over-the-counter JPY IRS transactions

After the cessation of LIBOR publication, most of JPY interest rate swaps (IRS) have traded by compounding daily TONA basis in the OTC market.

Incorporating quarterly interest exchange convention into the product specification, Three-month TONA futures will make an ideal substitution or hedging tool for IRS.

Making risk management and trading operation further efficient

As it is well aligned with IRS, exchange-traded Three-month TONA futures will enable more calibrated market risk management, mitigating counterparty credit risk and reducing burdensome operations associated with IRS.

Product outline

| Underlying asset | Compounded daily TONA during a period of 3 months from the contract month | |

|---|---|---|

| Trading unit | 1 Basis point value (price fluctuation of 0.01) = 2,500 yen | |

| Price quotation | 100 minus rate of interest | |

| Tick size & value | 0.001(0.001%=250 yen) | |

| Contract months | Nearest 20 Quarterly Months(3,6,9,12)= 5 years | |

| Reference Quarter【Trading Calendar】 | From the third Wednesday (and including) of each contract month (3,6,9,12) to the third Wednesday (but excluding) of the month (6,9,12,3) that falls 3 months later. ※If the third Wednesday falls on a Japanese bank holiday, it begins on (and including) immediately following Japanese bank business day and ends on (but excluding) immediately following Japanese bank business day. |

|

| Last trading day【Trading Calendar】 | The third Wednesday of the calendar month following each contract month by 3 months ※If the third Wednesday falls on a Japanese bank holiday, immediately following Japanese bank business day. |

|

| Final settlement day | The first business day following the last trading day | |

| Final settlement | Cash settlement | |

| Final Settlement Price | The final settlement price is calculated and presented to 3 decimal places (0.1 tick). The final settlement price is 100 minus the annualized compounded daily TONA, which is calculated by multiplying TONA of each business day in Reference Quarter for the relevant contract month together, dividing it by actual number of days in the Reference Quarter, multiplying 365 (annualizing) and rounding off at 4 decimal places expressed in percentage. |

|

| Trading hours (JST) | 8:30 - 8:45 | Pre-open period (Order entry without execution) |

| 8:45 - 11:30 | Day(morning) session (Cleared as today's trade) | |

| 11:30 - 12:30 | Restricted period (Cancel and volume cutback only) | |

| 12:30 - 15:30 | Day(afternoon) session (Cleared as today's trade) | |

| 15:30 - 20:00 | Evening session (Cleared as the next day's trade) | |

| Trading hours for the contract on its last trading day (JST) | 8:30 - 8:45 | Pre-open period |

| 8:45 - 9:30 | Day session | |

| Matching Method | Auction method with FIFO algorithm (Price/Time Priority) | |

| Strategy Trades | Calendar spread trading | |

| Implied Function | Implied-in and Implied-out | |

| Block Trades | Available (Minimum volume: 1 contracts) | |

| Give-up Trades | Available | |

| Margin | SPAN® | |

| Ticker Code | Refinitiv【0#J03:】 Bloomberg【YPOA Comdty】 QUICK【030】 CQG【F.US.O3】 Trading Technologies【O3】 |

TONA final result | Refinitiv【JPONMUF=RR】 Bloomberg【MUTKCALM Index】 Quick【TNAR@】 Bank of Japan 【Call Money Market Data】 |

Calculation method of TONA’s daily compounded rate and final settlement price

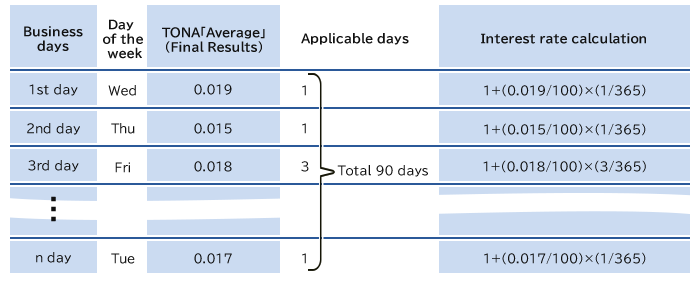

[Prerequisite]

Reference Quarter:Suppose the number of calendar days during the Reference Quarter (From the third Wednesday of the Contract Month to the third Tuesday in three months ahead) is 90.

[Step 1]

Obtain the TONA (Final Results of Average) for respective day during the Reference Quarter.

[Step 2]

Multiply interest rate for each day (or days) to which the same daily TONA is applied during the Reference Quarter together and making the compounded rate of the Reference Quarter (90 days).

{1+(0.019/100)×(1/365)}×{1+(0.015/100)×(1/365)}×{1+(0.018/100)×(3/365)}…×{1+(0.017/100)×(1/365)}-1=0.00004625

[Step 3]

To annualize the compounded rate of the 90 days at Step 2 above, multiply the rate by 365/90.

0.004625×365/90=0.000187…

[Step 4]

To make it expressed in percentage figure, multiply by 100 and round off at the fourth decimal point, making the rate (R). 100- R will be the final settlement price.

100-(0.000187…×100)=100-0.019…=99.981

Practical use of Three-month TONA Futures

A Three-month TONA futures is an agreement to buy or sell a certain volume of the predetermined compounded daily TONA during specific three months’ Reference Quarter.

For example, a price of the contract month of September 202X is indicative of the compounded daily rate during three months from the third Wednesday of September 202X to the third Tuesday of December 202X, which is then annualized.

Like quotation of bond price, its price quotation is displayed as 100- Interest rate (%). Therefore, the following correlation is found between an interest rate and a futures price.

(Example)When the annualized compounded daily TONA rate for a certain Contract Month is 1.2%, the futures will be displayed as 100-1.200= 98.800.

Utilizing Three-month TONA Futures as an indicator of a future interest rate

Price of Contract Month June 2025 at 99.530 → 100−99.530 = 0.470%

Price of Contract Month September 2025 at 99.480 → 100−99.480 = 0.520%

Price of Contract Month December 2025 at 100.438 → 100−99.438 = 0.562%

When prices of contract months in the distant terms are lower than those of nearer-term contract months like the case above, it is expected that JPY short-term interest rate will gradually rise for the next few months.

Incentives

- please contact Wholesale Business Department.

Market information

Publication

For details, see "Outline for Three-month TONA Futures"

For order types and modifiers available for this product, see "Order Types".