Products Overview

Comprehensive exchange for financial derivatives

Products listed and traded are as follows.

We contribute to the sound development of the financial markets and the economy of Japan by developing financial instruments markets as public infrastructure related to financial instruments transactions that provide a superior degree of fairness, reliability, and convenience.

* Nikkei Stock Average(Nikkei 225)

* Nasdaq-100®

* DAX® is a registered trademark of Qontigo Index GmbH, part of Deutsche Borse Group.

Three-month TONA futures

A “Three-month TONA futures” is a market derivatives transaction, which quotes the financial index indicated as 100 minus the figure of an interest rate per annum as compounded daily Uncollateralized Overnight Call Rate (TONA) interest during the “Reference Quarter”; TONA shall be published by the Bank of Japan (BOJ) .

“Reference Quarter” shall be, for a given contract month, the interval that ends on (but excluding) the third Wednesday of the calendar month in which the last trading day falls (“delivery month”) and begins on (and including) the third Wednesday of the calendar month preceding the delivery month by three months; provided however, that if the third Wednesday of the delivery month is a Japanese bank holiday, the interval ends on (but excluding) the immediate following Japanese bank business day and if the third Wednesday of the third calendar month preceding the delivery month is a Japanese bank holiday, it begins on (and including) immediately following Japanese bank business day.

“TONA” shall be the interest rate of Uncollateralized Overnight Call Rate for a business day expressed as “average” in percentage and published by BOJ on the following business day as the final result.

In calculating compounded interest, for any holiday belonging to the Reference Quarter, the TONA for the immediately preceding business day shall be applied to each holiday as simple interest rate (not compounded one).

“the figure of an interest rate per annum” is a percentage value of the compounded daily interest divided by the number of calendar days included in the Reference Quarter and multiplying by 365 (round off to the third decimal place)

The price for Three-month TONA Futures is structured as below: 100-Interest rate (%) .Therefore the following correlation is found between an interest rate and a futures price:

Ex. When an interest rate of TONA Three-month is 1.200%, its price will be displayed as:100-1.200=98.800

Options on Three-month TONA futures

Options on Three-month TONA futures are the right to enable the Option buyer to buy or sell a certain volume of Three-month TONA futures contracts at a predetermined price (the"strike price").

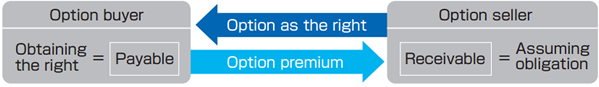

Structure of option trading

The option buyer obtains the right by paying option premium to the option seller, and in consideration of the option premium, the option seller assumes the obligation to let the option buyer exercise the right (“exercise”or “option exercise”). In option trades, the option premium is dealt. The option price is influenced by the futures price of underlying assets and other factors.

Option Types

There are two types of option products, i.e., put options and call options.

Put : Options that give a buyer the right to sell TONA futures at a strike price.

Call : Options that give a buyer the right to buy TONA Futures at a strike price.

Options products provided by TFX are of American type, giving an option buyer the right to exercise anytime prior to the expiry date. An option buyer may close the option trade by reselling a position in the market, instead of option exercise, and an option seller may close the position trade by covering a position. The buyer’s right will be exercised automatically at the expiry date if the option exercise would produce a profit (In The Money) on the expiry date. On the other hand, the buyer’s right will be extinguished automatically at the expiry date if the option exercise would produce no profit (At The Money/Out of The Money) on the expiry date.

FX Daily Futures contracts ( Click 365 )

We can see TV report about foreign exchange transactions on a routine basis. Professionals of foreign exchange dealers at banks or security firms are main players dealing with such transactions in the inter-bank market. The transactions happen in the global inter-bank market including Tokyo, Europe and USA beyond the time-zone difference and around the clock.

The FX daily Futures contracts in TFX bases the above inter-bank foreign exchange transaction. TFX introduced the contract to allow end-users such as individual investors to make transactions in fair and transparent manner. It allows larger amount of business than deposited margin (so called “leverage effect”). Therefore, investment efficiency is higher compared with foreign currency deposit.

FX Daily Futures contracts ( Click 365 ) : Official Website

Equity Index Daily Futures contracts ( Click Kabu 365 )

Incorporating major equity indices of home and abroad and ETF (Exchange-traded funds), Equity Index Daily Futures contracts(Click Kabu 365) track the move of these indices and funds with tenure of up to 15-month period until reset. Investors of Click Kabu 365 are allowed to trade for the amount up to several to several tens of times the deposited margin, using leverage effect that is similar to Click 365. Click Kabu 365 offers you a wide variety of products including those of major equity indicies and ETF on commodities (precious metals and crude oil etc.); you can trade any of these products in a single account.

Equity Index Daily Futures contracts ( Click Kabu 365 ) : Official Website

Trading Members

Trading Members shall be classified into three types, "Interest Rate Futures Trading Members" ,"FX Daily Futures Trading Member" and "Equity Index Daily Futures Trading Member".