Trading Membership

Outline of Trading Membership

What is a Trading Member?

A Trading Member is a TFX market participant that has been approved Trading Qualifications from TFX, and trades financial futures on the TFX market. Trading Members can directly trade on TFX without the brokerage of another party. TFX's current Trading Members are from a wide range of areas, including banks, securities firms, central cooperative financial institutions, and foreign banks and securities operating in Japan. Varieties of participants show our market's openness towards a wide range of customers.

Types of Trading Members

There are six types of trading qualifications.

When a new product is listed, TFX will either expand the types of futures products tradable within the existing qualifications, or create a new qualification, depending on the necessities of the new product.

| Types of Trading Qualifications | Tradable Products |

|---|---|

| Euroyen Futures Trading Membership | Three-month Euroyen futures, Options on Three-month Euroyen futures, Six-month Euroyen LIBOR futures,Over-Night Call Rate futures can be traded. |

| Euroyen Futures Remote Trading Membership | |

| Yen Interest rate Swap Futures Trading Membership | TFX suspended Yen Interest Rate Swap Futures (¥ Swapnote™) as of 20 March 2007. |

| FX Daily Futures Trading Membership | FX Daily Futures contracts can be traded. |

| Equity Index Daily Futures Trading Membership | Equity Index Daily Futures contracts can be traded |

| Equity Index Daily Futures Remote Trading Membership |

How a trade is executed

- A trading member places orders on the TFX market through the TFX trading system. For brokering of customers' trades, the trading member must be a licensed financial futures broker.

- Offset notification is made when the executed trade is for settling an existing open interest position.

- Mark-to-market on open interest is carried out daily using each day's settlement price, and the difference is paid/received between the clearing members and TFX. The required margin amount is also calculated daily, and deposits are added to or withdrawn between the clearing members and TFX.

Clearing Members

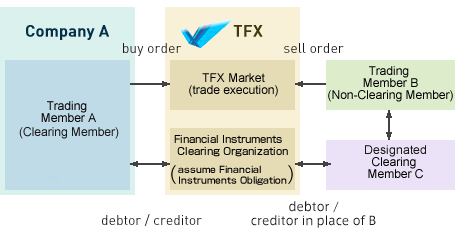

At present, Clearing Members are Trading Members who hold clearing qualifications and become TFX's counterparties for financial futures clearing businesses. Specifically, Clearing Members go into a direct credit-debt relationship with TFX upon a financial futures trading execution, and settle funds and pay/receive margins with TFX. This framework considerably reduces Clearing Members' counterparty risks which tend to become issues in OTC transactions.

Our Clearing Members are composed of banks, securities firms, central cooperative financial institutions, credit associations, and foreign banks and securities firms who satisfy the specified financial requirements.

How to Become a Trading Member

Process of obtaining trading qualification

- Please contact TFX for procedures to obtain trading qualification. TFX will explain the necessary procedures and requirements, as well as the necessary technical environment for trading.

- Turn in a Trading Qualification Application Form to TFX.

- TFX will examine the application based on the specified qualification.

-Trading Qualification Requirements

- A corporation having a principal or liaison office in Japan.

- Having human resources capable of financial futures trading.

- Having good financial standing.

- If the trading qualification applicant does not obtain clearing qualification, a Clearing Agreement must be entered into with a Designated Clearing Member.

- After trading qualification is approved, the necessary procedures (system set-up, payment of trading registration fee, etc.)are to be taken, after which trading becomes possible on the TFX market.

Costs to be a trading member

Trading Registration Fee

| Types of Trading Qualifications | Trading Registration Fee |

|---|---|

| Euroyen Futures Trading Member | 10,000,000 yen(∗2) |

| Yen Interest rate Swap Futures Trading Member(∗1) | 5,000,000 yen |

| FX Daily Futures Trading Member | (∗3) |

| Equity Index Daily Futures Trading Member | (∗3) |

| Equity Index Daily Futures Remote Trading Member |

- (∗1) TFX suspended Yen Interest Rate Swap futures (\ SwapnoteTM) as of 20 March 2007.

- (∗2) Trading members who have a license to trade FX Daily Futures contracts will be required to submit 5,000,000 yen as the trading registration fees of Euroyen futures if they seek a license to trade Euroyen futures. For the trading registration fee of the Euroyen Futures Remote Trading Membership, please contact Wholesale Business Department.

- (∗3) Please contact Retail Business Marketing Department.

System Set-Up Costs

With regard to system set-up costs of Euroyen futures trading and exchange forex/equity index Daily Futures Trading, please contact Wholesale Business Department and Retail Business Marketing Department respectively.

Market Entry Deposit

Deposit to TFX in case of Trading Member's default.

For details, please see Article 12 of "Trading Member Regulations".

| Trading Members who conduct Interest Rate Futures transactions based on their Customers' orders | Other Members |

|---|---|

| 10,000,000 yen | 3,000,000 yen |

Monthly Exchange Fee

| Types of Trading Qualification | Fee(monthly) |

|---|---|

| Euroyen Futures Trading Member | 300,000 yen |

| Euroyen Futures Remote Trading Member | |

| Yen Interest rate Swap Futures Trading Member | |

| FX Daily Futures Trading Member | 50,000 yen |

| Equity Index Daily Futures Trading Member | 50,000 yen |

| Equity Index Daily Futures Remote Trading Member |

Per-contract Exchange Fee

Per contract Exchange fee varies depending on trading volume.

For details,please see Article 4 of "Regulations for Trading Registration Fees and Other Charges".

- ∗ Additional fee may be charged for Interest Rate Futures Contracts. For more information, please contact Wholesale Business Department.

With regard to market entry deposits of FX Daily Futures contracts and Equity Index Daily Futures contracts, please contact Retail Business Marketing Department.