Clearing Membeship

What is a Clearing Member?

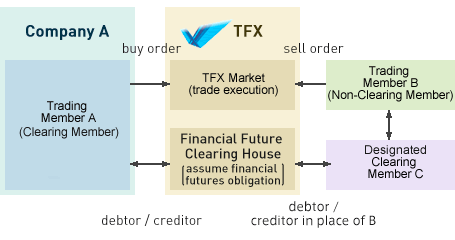

Clearing Members are Trading Members who hold clearing qualifications and become TFX's counterparties for financial futures clearing businesses. Specifically, Clearing Members go into a direct credit-debt relationship with TFX upon a financial futures transaction, and settle funds and pay/receive margins with TFX.

TFX's Clearing Members are banks, securities firms, central cooperative financial institutions, and foreign banks and securities who satisfy the specific financial requirements. Because TFX is the counterparty for all trades, and Clearing Members hold joint responsibility upon debt obligations, trading on TFX greatly reduces counterparty risk (credit risk of trade counterparty) compared to over-the-counter (OTC) trading.

Clearing for Non Clearing Member

A Clearing Member who has approved for financial futures brokerage by the Financial Service Agency of Japan can assume clearing businesses for trades of a Non-Clearing Member (Trading Member). Specifically, a Clearing Member goes into a direct credit-debt relationship with TFX in place of a Trading Member, and settles funds and pay/receive margin with TFX. By assuming clearing businesses, a Clearing Member can explore new business opportunities such as accepting clearing commission from a Trading Member, etc. In order to clear trading member’s transactions, a Clearing Member needs to enter into a Clearing Agreement with a Trading Member, and become such Trading Member's "Designated Clearing Member".

Key businesses of Clearing Member

A Clearing Member conducts

- Settlement of funds and payment/receipt of margins, etc. with TFX upon a market derivatives trading execution on the TFX market.

- (In case of a Designated Clearing Member,) settlement of funds and payment/receipt of margins, etc. with TFX in place of Trading Members

How to become a Clearing Member

Process of obtaining clearing qualification

- Please contact TFX for procedures to obtain clearing qualification. TFX will explain the necessary procedures and requirements, as well as the necessary systematic environment for trading.

- Turn in a Clearing Qualification Application Form to TFX. If Trading Qualification is not yet obtained, turn in a Trading Qualification Application Form also.

- TFX will examine the application based on the specified qualification.

(Clearing Membership Qualification Requirements)- A corporation having a principal or liaison office in Japan.

- Having Trading Membership in the contracts for which clearing services are provided.

- Having human resources capable of market derivatives transaction and assuming clearing operations.

- Having good financial standing.

After clearing qualification is approved, the necessary procedures (system set-up, payment for trading registration fee, etc.) are to be taken, after which trading becomes possible on the TFX market.

Clearing Membership fee, etc.

For costs associated with obtaining TFX Clearing Membership, see “Regulations for Trading Registration Fees and Other Charges”.

And for Clearing Deposit, see Article 32 of "Clearing Regulations".