- HOME

- For Retail Clients

- FX Daily Futures contracts Click365

FX Daily Futures contracts Click365

We can see TV report about foreign exchange transactions on a routine basis. Professionals of foreign exchange dealers at banks or security firms are main players dealing with such transactions in the inter-bank market. The transactions happen in the global inter-bank market including Tokyo, Europe and USA beyond the time-zone difference and around the clock.

FX Daily Futures contracts in TFX bases the above inter-bank foreign exchange transaction. TFX introduced the contract to allow end-users such as individual investors to make transactions in fair and transparent manner. It allows larger amount of business than deposited margin (so called "leverage effect"). Therefore, investment efficiency is higher compared with foreign currency deposit.

For further details, please click here.

Contract Specifications

| Date of Listing | July 1, 2005 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Type of Trade | Cash-settled Futures transaction (Rolling Spot Futures) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Underlying Assets | (1)Yen Currency Pairs (21 pairs)

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Trading Method | Market-Making Method For further information about Market-Making Method, please refer to https://www.click365.jp/en/start/start01.html |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Daily Settlement Price | A FX Daily Settlement Price is obtained by reference to the contract price of the relevant FX Daily Futures contract that has been executed by Market-Making Method during a specific period of time before the close of the Market Trading Period for the relevant trading day as may be determined by the Exchange. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Contract Term | Daily Futures (Rolling Spot Futures) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

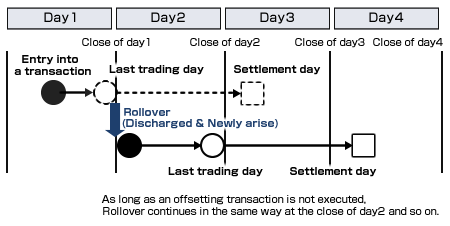

| Rollover | Positions not settled at the close of the Market Trading Period of each trading day are discharged, and concurrently therewith, positions under the same terms and conditions as those of the discharged positions, except for their contract day being the trading day immediately following that trading day, newly arise between the Exchange and the Clearing Member who has held the discharged position.  |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Trading Hours | (1)Yen Currency Pairs (All are written in JST)

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Contract Unit/ Tick Size |

(1)Yen Currency Pairs

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Margin | For individual customers, margins are calculated based on the maximum leverage ratio of 25 times as prescribed in the relevant laws and regulations. For Trading Members or Non-Individual Customers, TFX determines the Margin Reference Amount that covers 99% confidence level of the fluctuation distribution generated by applying the statistical method to the data on the daily price fluctuation of each product (herein-after called “HV method”). The sample periods are past 8 weeks and 104 weeks, and the larger of the two calculation results is adopted. Additionally, for Market Makers, the minimum margin ratio calculated on the basis of historical price movement is adopted by each product. In principle, the Margin Reference Amount is reviewed on a weekly basis. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Position Limit | In general, position limits are not applicable; however, the Exchange may limit the volume of a Trading Member’s position whenever the Exchange deems it necessary to do so in order to maintain the regularity of the Exchange Market and protect the public or customers interests. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Exchange Holiday | Saturday, Sunday, New Year's Day and January 2nd only when January 1st falls on a Sunday.

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Ticker Symbol | Reuters Contract Detail : JPY=TF, EURJPY=TF, EUR=TF, JPYL=TF, etc. Bloomberg : TFXJ |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

- Our Business

- Sound and Secure Exchange

- Financial Information

- History

- Trading Membership

- Three-month TONA Futures

- Options on Three-month TONA Futures

- Market Data Services

- System Information

- Clearing and Settlement Services for Corporate Customers

- List of TFX Trading Members