Overview of Clearing and Settlement Services

Tokyo Financial Exchange Inc. (TFX), an exchange that creates markets for derivatives, is also a clearing house that provides clearing services-acting as the counterparty in trades executed in the markets, assuming obligations, and guaranteeing performance of settlement.

What is a Clearing House?

TFX provides clearing services for all products listed on TFX as a Financial Instruments Clearing Organization engaged in the financial instruments obligation assumption service with a license/approval obtained from the Prime Minister under the Article 156-2 and other provisions of the Financial Instruments and Exchange Act of Japan.

Listed products on TFX include interest rate futures contracts, FX Daily Futures contracts, and Equity Index Daily Futures contracts.

The Functions and Importance of a Clearing House

Derivatives contracts are largely divided into exchange-traded contracts and over-the-counter (OTC) contracts that are not traded on exchanges. The biggest difference between exchange-traded and OTC contracts is whether they involve a clearing house or not.

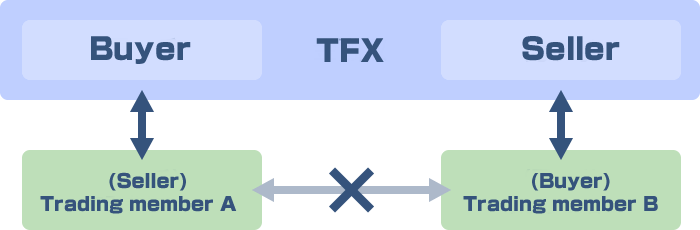

In the derivatives market, where many contracts (sale/purchase) are executed daily and anonymously by many market participants, settling with the actual counterparty of a contract is inefficient and requires a consideration of the credit risk on individual counterparties.

Therefore, TFX, which also serves as a clearing house, plays the important roles of assuming obligations and guaranteeing the performance of settlement by acting as the counterparty in all contracts executed in TFX markets.

(Note) Trading members A and B are assumed to be members with clearing membership qualifications.

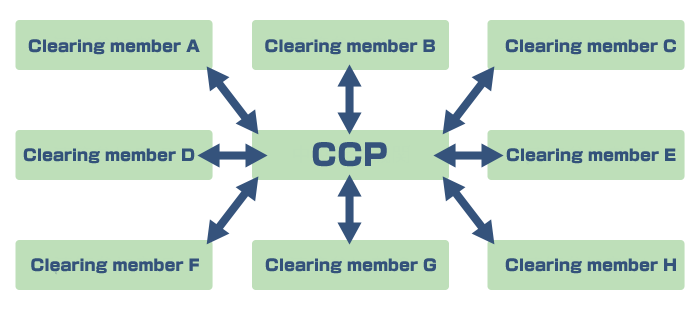

A clearing house is also generally called "Central CounterParty (CCP)" as it acts as the counterparty in all contracts of all members.