Market Data Services (for non-trading members)

Overview ⁄ Market Data Services (for non-trading members)

TFX provides market data to non-interest rate futures trading members ("non-trading member") with certain fees.

There are two types of services for non-trading members' use of market data; (1) Internal Usage and (2) External Usage.

∗ A non-trading member will be able to use market data (1) internally (Internal Usage) or ⁄ and (2) externally (External Usage) by arranging necessary system infrastructure as well as entering into contractual agreement with TFX. For details, please see "procedures".

(1) What is "Internal usage"

It means use of market data within a non-trading member company and its consolidated, affiliated companies (excluding partially consolidated companies) approved by TFX .

(2)What is "External Usage (third party distribution)"

It means any use of market data outside the "Internal usage". For example, if a non-trading member redistributes market data to (a) third party, this will be considered as an external use of market data.

For Non Display Usage(PDF 80KB)

Data and Contents

TFX provides the following market data to direct users. If you are an indirect user, please enquire a direct user of your choosing what type of data and contents you can receive.

∗ Direct user is a party who receives market data through a direct connection to TFX, and indirect user is a party who receives market data through a direct user.

Data

| Three-month TONA Futures | Product info. |

|---|---|

| Options on Three-month TONA Futures | Product info. |

| Three-month Euroyen Futures (trading suspended) |

----- |

| Options on Three-manth Euroyen Futures (trading suspended) |

----- |

TFX suspended Three-month Euroyen futures as of 1 July 2024 and Option on Three-month Euroen futures as of 20 March 2023.

Contents

| Best Bid ⁄ Offer | Best Bid ⁄ Best Offer (Price, Volume) |

|---|---|

| Market Depth | Bid ⁄ Offer (Price, Volume) |

| Open ⁄ High ⁄ Low ⁄ Close Price | Opening price ⁄ Highest price ⁄ Lowest price ⁄ Last traded price ⁄ Indicative opening price ⁄ All-Time high ⁄ All-Time low ⁄ Change from previous day ⁄ Trading volume |

| Settlement Price | Settlement price ⁄ Intraday settlement price ⁄ Final settlement price ⁄ Official closing price |

| Open Interest | Open interest |

| Exercised Volume | Exercised volume |

Fees

Monthly "market data usage fees" which are sum of "basic fee" and "Purpose specific usage fee" described in the following table, will be applied to a non-trading member's use of market data.

1. Basic Fee

Basic fee will be determined by number of network line that connects to ITA Wave. If multiple data usages are applicable, only the highest rate shall apply.

(1) Direct Usage

∗ Direct users can only receive a real-time market data.

(2) Indirect Usage

Only an indirect user can subscribe delayed or ⁄ and closing price data∗1.

Regardless of number of lines connecting to a direct user, the following flat basic fee shall be charged to an indirect user.

| Data | Basic Fee (monthly) |

|---|---|

| Market Depth ⁄ Open High Low Close Prices ⁄ BBO (Real-time) | JPY 1,000,000 |

| Open High Low Close Prices ⁄ BBO (Real-time) | JPY 550,000 |

| Open High Low Close Prices ⁄ BBO (Delayed) | JPY 100,000 |

| Closing Price | JPY 50,000 |

- ∗1 Direct user is able to supply a delayed market data to its clients (end users)

2.Purpose specific usage fee

Purpose specific usage fee will be determined by usage purposes ⁄ methods of the market data. Same fee schedule applies both for direct and indirect users; however the fee will vary by internal and external usages.

(1)Internal usage

Fees for internal usage are targeted at those individuals who use the data regularly such as for trading. News distribution, marketing, data collection, monitoring, back office and other such uses can be excluded.

- ∗2 In the case of internet users, one user ID should be counted as one terminal above.

- ∗3 Real-time information means the information provided within a period of less than ten minutes following to the actual occurrence of such information.

- ∗4 Delayed information means the information provided after a lapse of ten minutes following the actual occurrence of such information. (In order to avoid erroneous orders, delayed bid ⁄ offer quotes are prohibited to be used.)

(2) External Usage

Procedures

The following entry procedures are for direct users. If you are an indirect user, please enquire a quote vendor of your choosing for entry and necessary procedures or contact us here.

1. Application procedures

You will be asked to submit several reference documents regarding your company, such as company profile, financial report etc.

2. Contract procedures

Prior to starting system development, it is necessary to sign legal contracts regarding use of the market data with TFX.

3. Technical Procedures

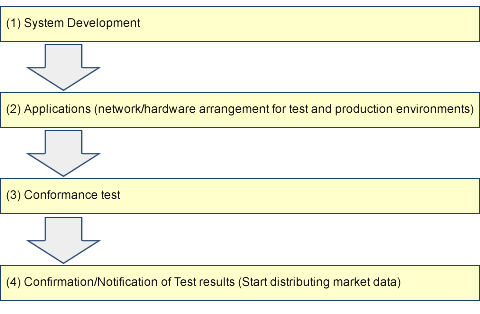

The following is a basic process for arranging the necessary infrastructure for using market data, such as system development, network arrangement, and conformance test.