Clearing and Settlement Services for Individual Customers (Investors)

Tokyo Financial Exchange Inc. (the “TFX”) provides clearing services for all products listed on TFX as a financial instruments clearing organization approved under the Financial Instruments and Exchange Act.

Clearing system for FX Daily Futures contracts (Click 365) and Equity Index Daily Futures contracts (Click Kabu 365)are explained as follows.

Overview of Margin System

To trade Click 365 and Click Kabu 365, exchange margin (“margin”) is required. Investors deposit margin with TFX through Trading Members. Margin must be all in cash in yen and securities cannot be deposited as margin.

(i) Ordering margin

Ordering margin is required when a customer (investor) places a new order.

If TFX specifies the margin reference amount ((ii) below) at JPY 40,000 and a Trading Member sets the discretionary amount of margin at JPY 20,000, JPY 60,000 in total will be the ordering margin per one trading unit. Therefore, in this case, a customer needs to deposit at least JPY 60,000 with TFX through the Trading Member in order to place a buy (or sell) order of one trading unit.

(ii) Margin reference amount

A margin reference amount is the minimum required amount of margin per position specified by TFX for each product.

For Click 365, the margin reference amount of positions held is obtained by multiplying the larger of the short or long positions held (MAX Positions) by the margin reference amount.

For Click Kabu 365, it is obtained by multiplying the difference between short positions and long positions (Net Positions) by the margin reference amount.

TFX reviews margin reference amounts every week based on historical price movement risk.

See FX margin refrence amounts currently applied

See equity index margin reference amount currently applied

(iii) Discretionary margin

A Trading Member can set the amount of discretionary margin for the purpose of managing risk of trades by customers (investors). By setting the amount of discretionary margin, the range up to the loss-cut level of a customer (investor) position can be widened.

(iv)Orderable amount

Orderable amount refers to a surplus of margin calculated by subtracting margin requirement for maintaining positions held and payment instructions, etc. from the deposited amount of margin. Basic formulas are stated below. The basic formulas for calculating orderable amounts below just represent basic ideas and they may differ depending on the Trading Member’s system setting and other factors. Depending on system specifications of Trading Members, payment instructions and brokerage commissions may not be included in the calculation of the orderable amount.

Click 365

Orderable amount = amount of margin deposited + (vii) FX variations ? (ii) margin reference amount x MAX Positions - (amount of payment instructions + brokerage commissions)

Click Kabu 365

Orderable amount = amount of margin deposited + (vii) Equity Index variation ? (ii) margin reference amount x Net Positions - (amount of payment instructions + brokerage commissions)

(v) Rollover

Positions not settled at the close of the Market Trading Period of each trading day will be rolled over to the next trading day.

In order to maintain positions by rollover, an amount of margin deposited that is higher than the margin requirement calculated at the close of the Market Trading Period of each trading day needs to be maintained.

(vi) Closing trade

Closing a trade means settling a position held (closing the position by resale or repurchase). Ordering margin is not required for an order to execute the settlement.

(vii) FX/Equity Index variation

- ? (1) FX variation

FX variation is the total amount of the following profits or losses.- Amount of initial FX revaluation profit or loss (revaluation profit or loss on rollover of a newly executed contract, calculated based on the difference between the settlement price for the trading day and the contract price).

- Cumulative amount of daily FX revaluation profits or losses (revaluation profit or loss on rollover of a position of the immediately preceding trading day, calculated based on the difference between the settlement price for that trading day and that of the immediately preceding trading day).

- Amount of fixed FX revaluation profit or loss (revaluation profit or loss calculated based on the difference between the contract price or the settlement price of the immediately preceding trading day of the position to be settled and the contract price of the trade for settling that contract)

- Cumulative amount of swap points (amount that reflects the difference in interest rates between currencies that arises due to rollover of positions)

A new margin requirement is obtained by adding or subtracting the FX variation at the close of the Market Trading Period.

The amount of fixed FX revaluation profit or loss is calculated to include the deposited margin on the settlement date.

The formula for calculating the margin requirement is as follows.

Margin requirement = margin reference amount x MAX Positions ± FX variation (unrealized profit or loss of positions held)*

* The amount is added if the positions held have an unrealized loss and subtracted if the positions held have an unrealized profit.

Margin is deemed deficient if the amount of margin deposited is less than the margin requirement.

- ? (2) Equity Index variation

Equity Index variation is the total amount of the following profits or losses.

- Amount of initial Equity Index revaluation profit or loss (revaluation profit or loss on rollover of a newly executed contract, calculated based on the difference between the settlement price for the trading day and the contract price)

- Cumulative amount of daily Equity Iindex revaluation profits or losses (revaluation profit or loss on rollover of a position of the immediately preceding trading day, calculated based on the difference between the settlement price for that trading day and that of the immediately preceding trading day)

- Amount of final Equity Index revaluation profit or loss (revaluation profit or loss calculated based on the difference between the contract price or the settlement price of the immediately preceding trading day of the position to be settled and the contract price of the trade for settling that contract)

- Cumulative amount of dividend amounts

- Cumulative amount of daily interest rate amounts

A new margin requirement is obtained by adding or subtracting the Equity Index variation at the close of the Market Trading Period. The formula for calculating the margin requirement is as follows.

Margin requirement = margin reference amount x Net Positions ± equity index variation*

*The amount is added if the positions held have an unrealized loss and subtracted if the positions held have an unrealized profit.

Margin is deemed deficient if the amount of margin deposited is less than the margin requirement.

(i) The amount of margin as aprecondition for abid or offer sabmission a customer (investor) is required to deposit (ordering margin) is (ii) the amount of margin specified by TFX (margin reference amount x trading units) plus (iii) the amount of discretionary margin determined by a Trading member (discretionary margin).

(iv) A customer (investor) can place new orders within the orderable amount.

For a trade newly executed, an investor selects either to (v) keep holding the position (rollover) or (vi) close the position (closing trade).

As of the close of the Market Trading Period of every trading day, (vii) the FX variation for Click 365 and the Equity Index variation for Click Kabu 365 are calculated for each investor based on the settlement price TFX determines for each product and reflected in the investor’s margin requirement. If a deficiency arises in margin, the investor needs to deposit additional margin in the amount of the deficiency or more with the Clearing Member Member by the deadline specified by the Clearing Member .

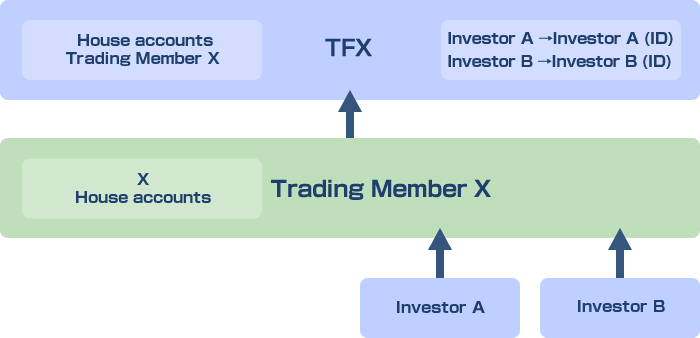

Protection of Customer (Investor) Margin

TFX adopts the segregated management system for margin. Under this system, Trading Members deposit customer (investor) margin with TFX and TFX manages margin balances by ID unit, which is assigned to each investor by Trading Members.